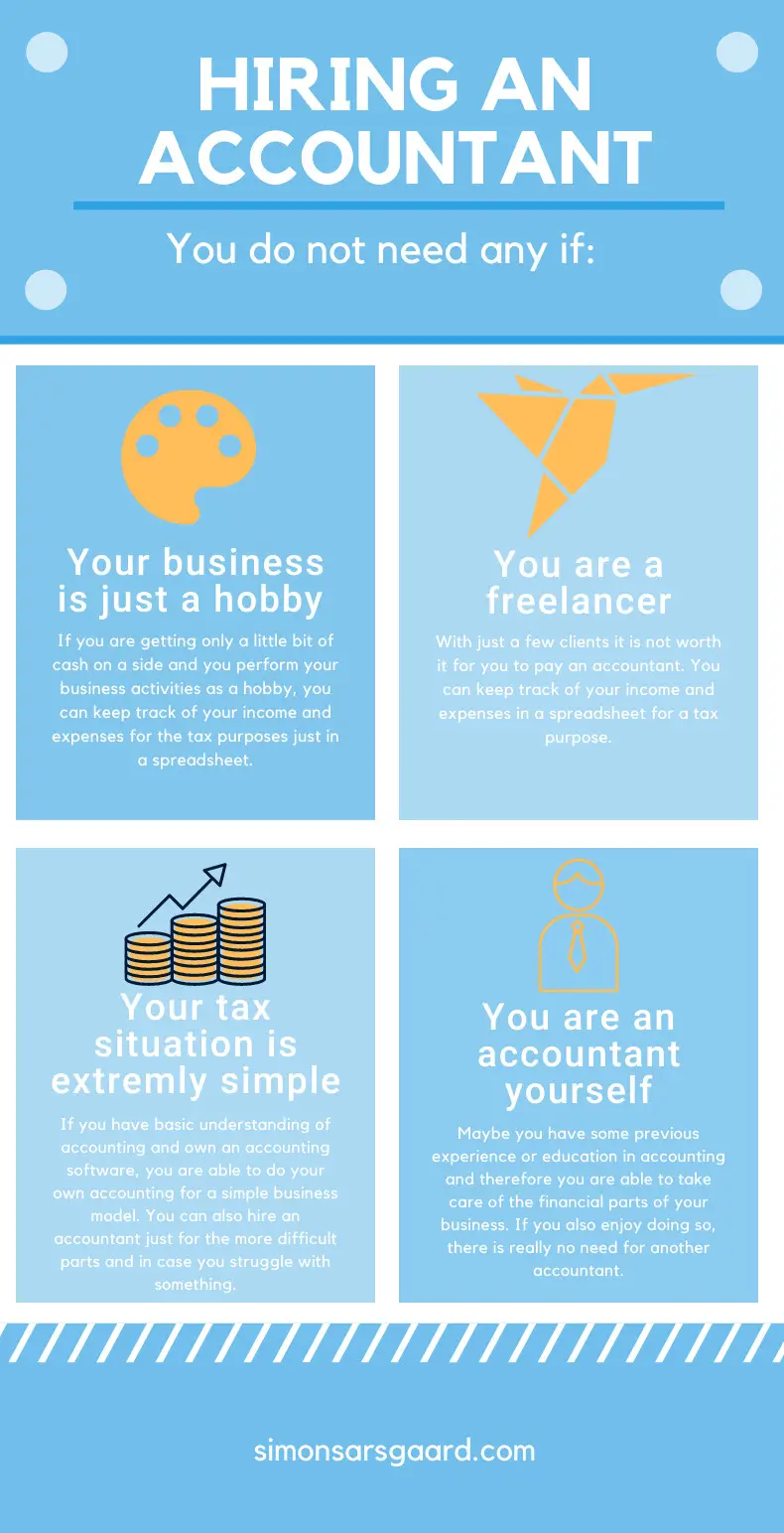

Are you starting a new business? I guess you are probably not very excited about the whole accounting part.

When should you get rid of this painful responsibility? When should you hire an accountant?

Hire an accountant as soon as possible, at the moment you can afford it. Every minute you spend bookkeeping and accounting is a minute taken away from other important revenue-generating business activities. Accounting done wrong will be costly, as you can easily end up paying fines and forgotten taxes.

You will not save money by doing accounting by yourself

Why not? Because an accountant is able to do your taxes, payrolls and all the business-related accounting matters much faster than you. For 10 hours you will spend trying to figure out the problem, the accountant will be done maybe in half of the time.

Now compare 10 hours of your salary with 5 hours of the salary of your accountant, add opportunity costs – how much revenue you could have made within those ten hours, and you have a nice picture of accountant costs vs savings. And the savings are even higher if you think about the scenario where you made some accounting mistake.

What do you need an accountant for?

#1 Accountant is a start to delegate your work

You feel like you are on top of everything and in control of your business and that is great. But when your business is growing and you are getting more and more clients, you will at one point realize you are stressed and overworked.

An accountant will take away part of your job, you just need to be willing to let go of a little bit of control. Hire a professional you trust and save yourself some worries.

#2 Accountant will help with a business plan

Even at the very early stage of the business, if you can afford it, an accountant will be helpful. You can get financial projections as a part of your business plan and make sure you are moving towards success.

#3 Accountant will help to keep financial overview

Keep track of invoices and who owes you, as well as where you need to pay which month, a good overview will save you costs on possible fines and keep good relationships with your clients and suppliers.

#4 Accountant will help you control employees productivity

By comparing revenue with salaries, you can see how the key business metrics are changing over time and how useful each employee is. You might find out problems early and address them or you might realize you need actually more people to generate higher revenue.

#5 Accountant will help you get a loan

For negotiating with a bank and getting a loan, the accountant will prepare a financial statement or do an audit of your company.

#6 Accountant will help you get information for your future business decisions

And that is very valuable mostly when things go wrong, like for example during a pandemic. The accountant should know about the financial aid options provided in your country, help you to develop a plan for an immediate survival of the company and make informed decisions about your future business.

How to recognize a qualified accountant?

If you decide to hire an accountant, make sure you are not wasting your time interviewing unqualified people.

- CPA or ACCA certification

- Knowledge and skills to work with accounting software

- Analytical thinking skills

- Good verbal skills, ability to explain

- Detail-oriented

CPA stands for Certified Public Accountant is provided to accountants who passed the CPA examination. Typically ethics are part of the examination and it is much easier to trust with your finances and accept advice from an accountant with a CPA.

ACCA is considered to be an equivalent of CPA for most of the european countries. There are different certificates provided by ACCA – Association of Chartered Certified Accountants.

Check what certification is an equivalent of CPA or ACCA in your country!

Do you need a bookkeeper?

Bookkeepers are supposed to keep track of data – expenses and purchases – and enter them into books. This serves as a basis for accountants.

It is possible to find an accountant who will do bookkeeping for your small business.

You can, however, do bookkeeping by yourself. It is not so difficult, bookkeepers, unlike accountants, are not required to have a specific education.

The basis is in writing all the transactions connected with your business. Every time you get paid, you pay someone else, transfer money to your personal account, basically any money movement.

Advantages and disadvantages of doing bookkeeping by your own

| + | – |

| You will save money | You need to have enough time |

| You will learn more about your expenses | You are more probable to do mistakes than a |

| You will have a better control over your business | It can get very boring |

| Your personal data are safer | You need to be an organized type |

…